Thinking about laser eye surgery can bring up many questions. You might wonder if your health insurance will help cover the cost. Many people ask, does Medicare cover laser eye surgery? This is a very common question, especially as we get older and our vision changes.

Vision correction surgeries often sound like a great idea. But, they are frequently seen as procedures you choose to have, not ones you medically need. There are some important exceptions to this view, though, especially concerning Original Medicare coverage versus benefits from a Medicare Advantage plan.

It’s good to understand these differences when thinking about whether your Medicare plan might help pay for any eye procedures you’re considering. We will explore more about if does Medicare cover laser eye surgery in this guide, looking at various scenarios and types of eye surgery procedures

Table of Contents

Does Medicare Cover LASIK?

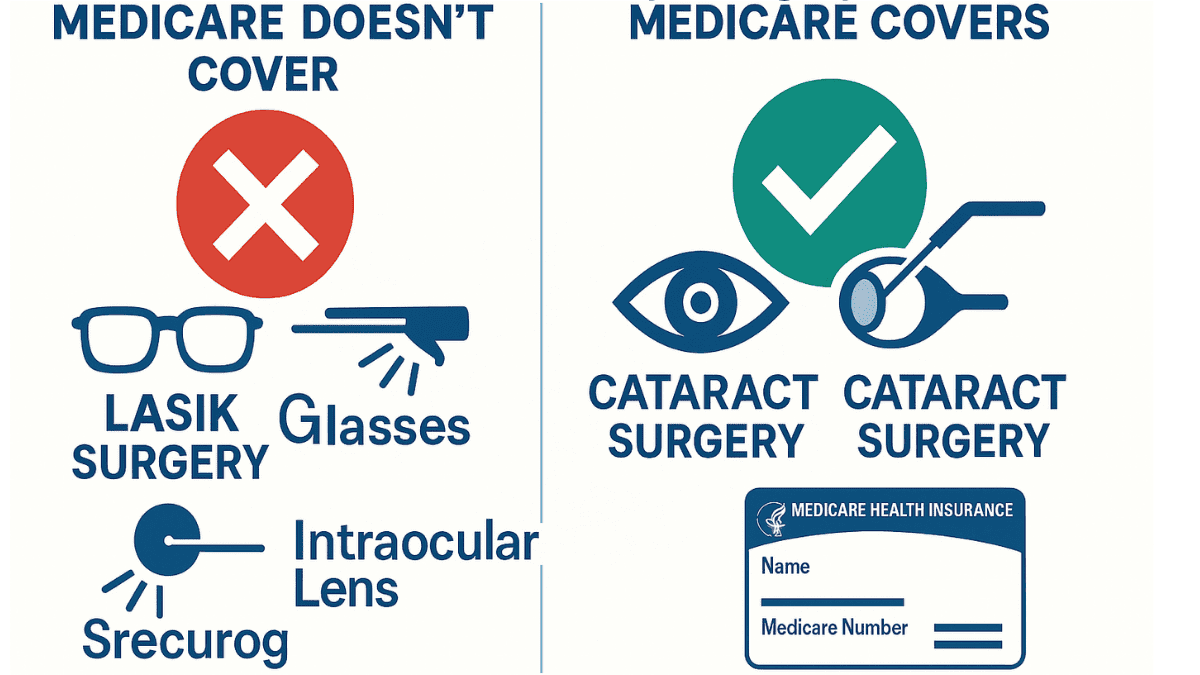

So, you’re hoping Medicare will help with LASIK, right? The short answer here is usually no. Original Medicare, which includes Part A (Hospital Insurance) and Part B (Medical Insurance), generally does not cover LASIK surgery.

Why is this the case? Medicare considers LASIK an elective procedure. This means it’s a surgery you choose to have, primarily for convenience or cosmetic reasons. It’s not typically seen as medically necessary to treat an illness or injury.

Medicare draws a line between procedures that improve your quality of life aesthetically or for convenience, and those that are essential for your health. For example, Medicare helps pay for surgeries to treat medical conditions, but not for purely cosmetic enhancements. Understanding this distinction is vital when considering the LASIK cost and potential coverage from your insurance plan.

LASIK primarily corrects refractive errors like nearsightedness, farsightedness, and astigmatism. While these conditions can be frustrating, glasses or contact lenses can generally correct them. Because other correction methods exist, Medicare doesn’t view LASIK for these purposes as a medical must-have. So, if your goal is just to stop wearing glasses, Medicare isn’t likely to chip in for LASIK surgery.

This is a key point for anyone asking ‘does Medicare cover LASIK eye surgery‘. The focus of Original Medicare is on medically essential treatments, not procedures chosen for lifestyle enhancement. If an eye surgeon recommends LASIK for vision improvement without an underlying medical necessity, Medicare will not provide coverage.

When Might Medicare Pay for Other Laser Eye Surgery?

While LASIK is typically off the table, Medicare might help pay for other types of laser eye surgery. This usually happens if the surgery procedure is medically necessary to treat a specific eye disease or injury. It’s not about just wanting clearer vision without glasses; it’s about treating a diagnosed health problem.

What kind of conditions might qualify for Medicare coverage for laser treatment? Think about situations where laser surgery fixes or slows a disease. For instance, after an eye injury, laser surgery might be part of repairing damage to the cornea, if it’s considered essential for restoring sight or eye health. This would be for specific types of damage, not routine vision correction, and an eye institute may be the best place for such specialized care.

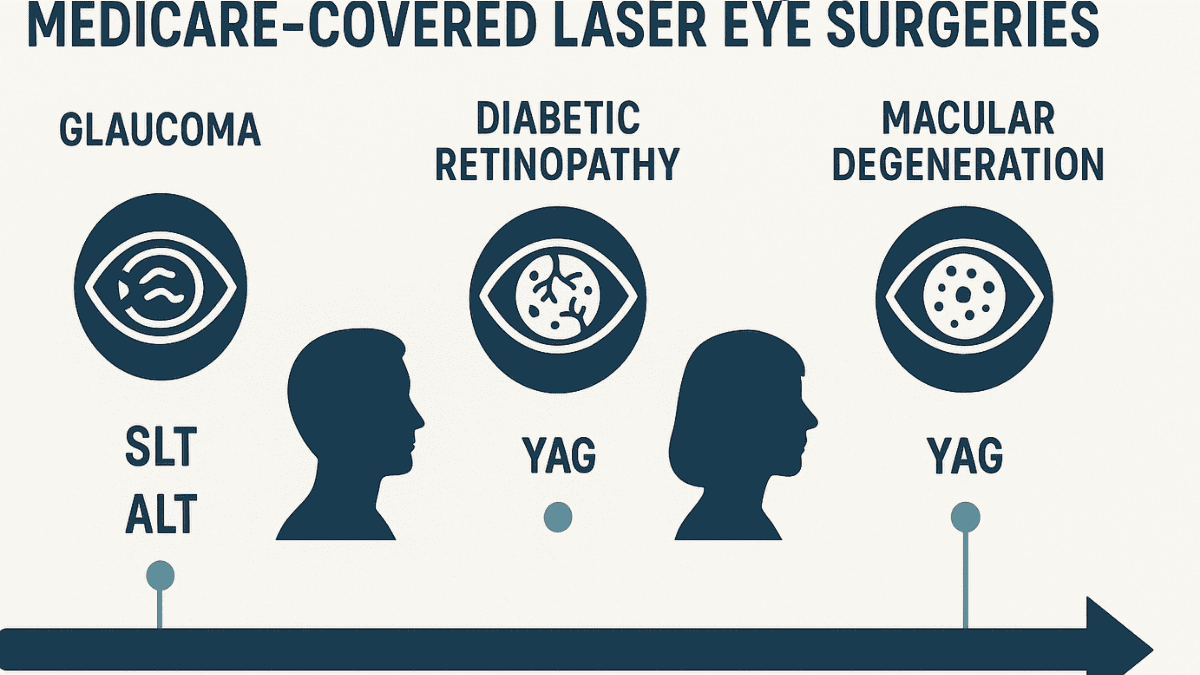

Medicare may cover laser surgeries for conditions like glaucoma. If you have glaucoma, your doctor might recommend a laser procedure to lower eye pressure. Treatments such as Selective Laser Trabeculoplasty (SLT) or Argon Laser Trabeculoplasty (ALT) are examples. These are very different from LASIK surgery as they target the underlying disease process of glaucoma.

Another area is related to cataracts. After standard cataract surgery, sometimes the lens capsule can become cloudy. A laser procedure called a YAG laser capsulotomy can clear this up. Medicare typically covers this if it’s needed because it restores vision lost after the initial, covered cataract surgery. This is sometimes referred to as a secondary laser cataract procedure.

Diabetic retinopathy is another condition where laser eye surgery might be covered. Diabetes can damage blood vessels in the eyes. Laser photocoagulation can help seal leaking vessels or stop new, abnormal ones from growing. This treatment can prevent vision loss from diabetic eye disease and is clearly a medically necessary procedure.

Similarly, Medicare may cover specific laser treatments for macular degeneration, particularly wet AMD. Laser photocoagulation can be used to treat abnormal blood vessel growth in the retina. This is not for vision correction like LASIK, but to prevent further vision loss from the disease.

It’s important to remember these are not the same as LASIK. These laser surgeries address specific medical problems. Your doctor must state that the laser surgery is needed to treat your condition. You will also need thorough documentation to support the medical necessity for your Medicare plans to consider coverage.

Here’s a brief comparison:

| Feature | LASIK Eye Surgery | Medically Necessary Laser Surgery (e.g., for Glaucoma, Diabetic Retinopathy) |

|---|---|---|

| Primary Purpose | Correct refractive errors (nearsightedness, farsightedness, astigmatism) for vision improvement. | Treat a diagnosed medical condition or disease (e.g., lower eye pressure in glaucoma, seal leaking blood vessels in diabetic retinopathy). |

| Medicare Coverage (Original Medicare) | Generally not covered (considered elective). | Often covered if deemed medically necessary by a physician and meets Medicare criteria. |

| Patient Goal | Reduce or eliminate dependence on glasses/contact lenses. | Manage or slow the progression of an eye disease, prevent vision loss, or restore vision impaired by a medical condition. |

| Examples | Standard LASIK, PRK for vision correction. | Selective Laser Trabeculoplasty (SLT) for glaucoma, YAG laser capsulotomy after cataract surgery, pan-retinal photocoagulation for diabetic retinopathy. |

Without proper documentation of medical necessity, Medicare won’t approve coverage. Understanding these distinctions is critical when discussing laser eye surgery options with your eye surgeon.

Does Medicare Advantage (Part C) Cover LASIK?

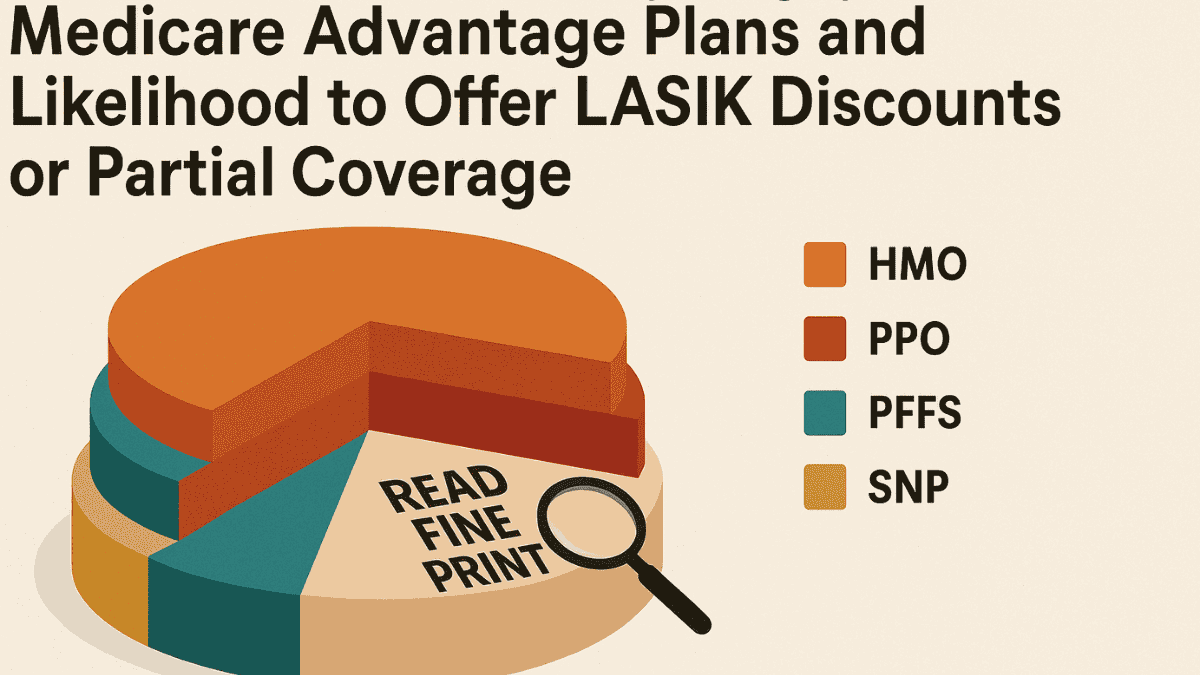

What about Medicare Advantage plans, also known as Part C? These Advantage plans are offered by private insurance companies approved by Medicare. They must cover everything Original Medicare covers. Sometimes, they offer additional benefits not included in Original Medicare Parts A and B.

So, does this mean your Medicare Advantage plan will cover LASIK surgery? It’s possible, but not guaranteed. Some Medicare Advantage plans cover or offer discounts or a partial allowance for LASIK. This is usually promoted as an additional benefits package that may include enhanced vision care.

You absolutely must check your specific plan documents. The Evidence of Coverage (EOC) and Annual Notice of Change (ANOC) for your Advantage plan will detail any vision benefits, including LASIK if offered. Don’t assume anything; read the fine print of your insurance plans carefully, looking for sections on routine vision care or elective procedures. You might also find this information on the plan’s website or by calling their member services number to understand the coverage details.

If a Medicare Advantage plan does offer some LASIK help, there might be strings attached. For example, you may need to use eye doctors or surgery centers within the plan’s network. Going outside the network could mean you pay the full surgery cost, even if a benefit exists. Always confirm these details before scheduling anything as Advantage plans offer additional benefits under specific conditions.

Even if a plan mentions LASIK, it might be a discount program rather than direct coverage. This means the Medicare Advantage plans offer a lower price with certain providers. You would still pay out-of-pocket, but at a reduced rate. Understanding what your Medicare Advantage plans offer additional in terms of real savings is very important for LASIK Medicare coverage.

Many Medicare Advantage plans offer additional benefits such as some coverage for eye examinations or even an allowance for eyeglasses. Check if your specific Advantage plan provides these extra perks. These benefits can vary widely, so reviewing what your specific plans cover is crucial.

Other Ways to Reduce the Cost of LASIK for Medicare Patients

If Original Medicare doesn’t cover LASIK and your Medicare Advantage plan offers little or no help, what else can you do? There are a few avenues to explore. These options might help make LASIK more affordable if you’re set on the surgery procedure, which includes understanding the overall LASIK cost.

HSA/FSA (if still employed or retired recently)

Were you contributing to a Health Savings Account (HSA) before retiring? Or maybe you still have access to a Flexible Spending Account (FSA) through work, or a spouse’s plan? These accounts let you set aside pre-tax money for eligible medical expenses. LASIK is generally considered an eligible expense for HSAs and FSAs.

Using HSA or FSA funds can significantly lower your out-of-pocket cost for LASIK. This is because you’re using tax-free dollars. Check the rules for your specific account to see how much you can contribute and use for such procedures.

Clinic Discounts or Senior Offers

Many LASIK centers and ophthalmology clinics understand the procedure is a big investment. They sometimes offer special promotions or discounts. It doesn’t hurt to ask if they have any senior offers or seasonal specials when checking on LASIK pricing.

Some clinics might also offer a lower price if you pay in full upfront. Others might have package deals that include follow-up appointments and post-operative care, which can be part of the LASIK recovery process. Always get a clear breakdown of costs before you commit.

Payment Plans (CareCredit, no-interest plans)

Paying for LASIK all at once can be tough. Many clinics offer financing options. Some partner with third-party healthcare credit companies like CareCredit. These companies often have plans that offer additional financing options, such as no interest if you pay the full amount within a certain timeframe, like 6, 12, or 24 months.

Just be sure you understand the terms. If you don’t pay it off in time, you could face high interest charges, often retroactively. Your LASIK clinic might also offer its own in-house payment plan; these plans offer varied terms, so ask about details. So, while we are talking about does Medicare cover laser eye surgery, these financial tools are worth investigating.

Medicaid + Medicare Dual-Eligible Status (may help with diagnostics, not LASIK)

If you have both Medicare and Medicaid (dual-eligible), this can help with some healthcare costs. Medicaid generally doesn’t cover elective LASIK either. However, it might help cover costs for eye examinations or diagnostic tests related to other eye conditions that Medicare also covers.

For instance, if you need a comprehensive eye exam to check for glaucoma or cataracts (conditions Medicare might cover treatment for), Medicaid could help with co-pays or deductibles that Medicare leaves. This doesn’t directly pay for LASIK, but it can reduce overall eye care expenses. This could free up some of your budget for other things, possibly including LASIK if you choose to pursue it separately.

LASIK Alternatives That Medicare May Cover

While LASIK itself isn’t usually on Medicare’s covered list, there are other vision-improving procedures and items Medicare might help with. These alternatives often address different eye problems than LASIK, but they can still lead to better vision and less reliance on glasses for some people, and it’s good to be aware of all lens options.

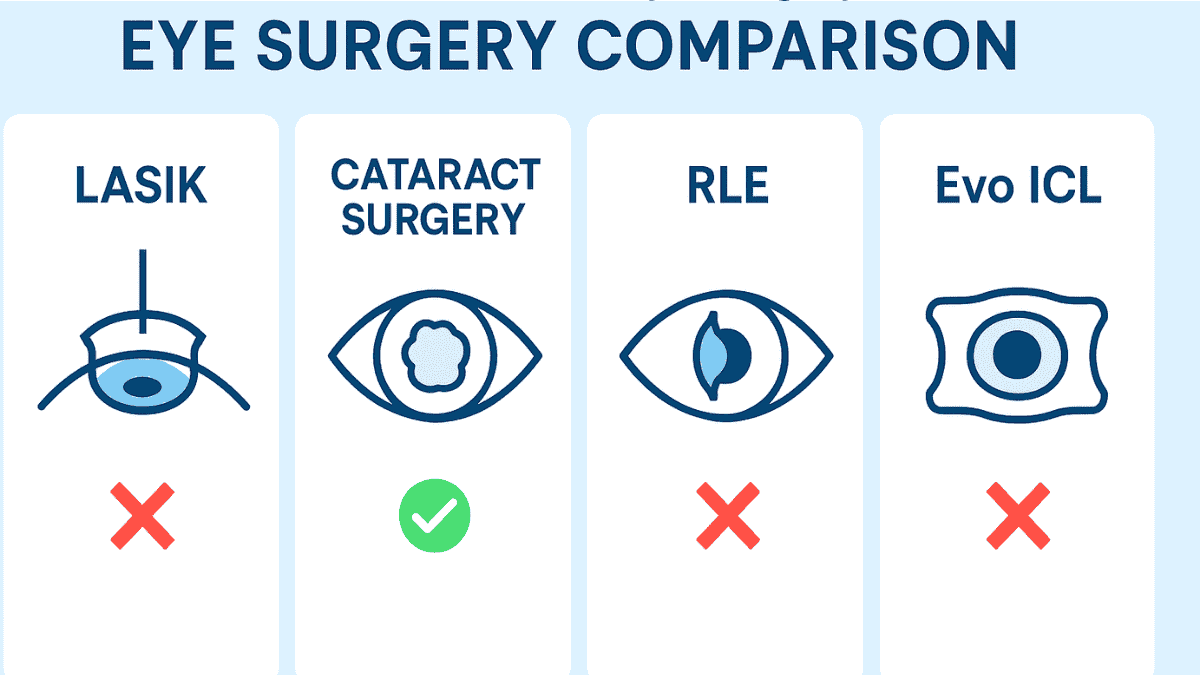

One of the most common eye surgeries for seniors is cataract surgery. Medicare Part B typically covers cataract surgery if it’s medically necessary, especially if cataract symptoms significantly impair vision. During this surgery procedure, the cloudy natural lens is replaced with an artificial intraocular lens (IOL). A standard monofocal IOL is usually fully covered, along with the surgeon’s and facility fees.

This type of lens corrects vision for one distance, usually far away. This often means you’ll still need reading glasses for close-up tasks. But, your overall vision can improve dramatically if cataracts are your main vision issue. Sometimes, laser cataract surgery, which uses a laser for certain steps, is an option, and Medicare coverage rules still apply primarily to the medical necessity of the cataract removal itself, not necessarily the advanced technology used unless it leads to a better medical outcome documented by the eye surgeon.

Some patients choose premium IOLs during cataract surgery, like toric lenses for astigmatism or multifocal lenses for a range of vision. Medicare does not pay for the extra cost of these premium lenses. However, Medicare will still pay its share for the cataract surgery itself and the cost equivalent of a standard monofocal lens. You would then pay the difference for the upgraded lens out of pocket.

Another procedure some consider is refractive lens exchange (RLE), also known as lens exchange. RLE is similar to cataract surgery in that the natural lens is replaced with an artificial one, but it’s typically performed to correct refractive errors before cataracts develop significantly. Like LASIK, RLE for purely refractive purposes is generally considered elective and not covered by Medicare. This means the refractive lens option is usually an out-of-pocket expense.

Implantable Collamer Lenses like Evo ICL are another vision correction option, especially for those who may not be ideal LASIK candidates. However, similar to LASIK and RLE, Evo ICL surgery is typically considered elective and not covered by Original Medicare. Some Medicare Advantage plans might offer discounts, but direct coverage is rare.

Are there other laser procedures like Photorefractive Keratectomy (PRK) or Laser-Assisted Subepithelial Keratomileusis (LASEK) covered? Generally, no, if they are for routine vision care correction, just like LASIK. However, in very rare cases, if PRK or a similar surface ablation procedure is medically necessary to treat a specific corneal disease or injury – for instance, certain types of corneal scars or recurrent corneal erosions that haven’t responded to other treatments – Medicare might consider coverage. This is very specific and would need strong medical justification.

Medicare may also cover treatments for severe dry eye if it is diagnosed as a medical condition and treatments are deemed necessary, such as prescription medications or punctal plugs. However, this coverage would not extend to LASIK, even if dry eye management is part of pre-operative or post-operative care for an elective procedure. In fact, significant dry eye can sometimes be a reason not to have LASIK.

Finally, don’t forget about basic vision correction. After cataract surgery with an IOL implant, Medicare Part B may help pay for one pair of eyeglasses with standard frames or one set of contact lenses. This benefit applies once per lifetime per cataract surgery that involves an IOL. While not a surgical alternative to LASIK, it’s a helpful benefit for many Medicare recipients needing vision correction after a covered eye surgery. Your annual eye check-ups are also important for monitoring overall eye health.

Many patients have questions about recovery times and potential side effects, often found in a LASIK FAQ. Discussing these with your doctor from a reputable eye institute will help you understand all aspects, including the LASIK recovery period. A thorough comprehensive eye exam is necessary before any such procedure.

Conclusion

So, back to our main question: does Medicare cover laser eye surgery? For LASIK aimed at correcting common refractive errors like nearsightedness or farsightedness, Original Medicare (Part A and Part B) typically says no. It views these as elective. The same applies to similar refractive procedures like refractive lens exchange for vision correction purposes.

But, this isn’t the end of the story for all laser eye procedures. Medicare often covers medically necessary laser treatments for conditions such as glaucoma, issues arising after laser cataract surgery (like a YAG capsulotomy), or diabetic retinopathy, and even certain treatments for macular degeneration. These are different procedures addressing specific health issues, distinct from enhancing vision through elective LASIK surgery.

If you have a Medicare Advantage plan (Part C), you might find some additional benefits or discounts for LASIK, but you must check your insurance plans’ coverage details very carefully. Always get any coverage confirmation in writing from Medicare or your Advantage plan provider before you schedule a surgery procedure. Talking with your eye surgeon about all your options, including different lens options if applicable, and their medical necessity is also a good step. Understanding what your Medicare plan will and won’t cover can help you make informed choices about your eye health and finances.

FAQ

No, Original Medicare (Parts A and B) does not typically cover LASIK surgery because it is considered an elective procedure for vision correction rather than a medically necessary treatment.

Medicare may cover laser eye surgeries when they are deemed medically necessary, such as for treating glaucoma, diabetic retinopathy, or secondary cataract procedures like YAG laser capsulotomy.

Some Medicare Advantage (Part C) plans may offer LASIK discounts or limited vision benefits, but coverage varies widely between providers and must be confirmed in your specific plan’s Evidence of Coverage.

Yes, Medicare typically covers cataract surgery using traditional or laser-assisted methods if the procedure is medically necessary. However, it only covers the cost of standard monofocal lenses.

In extremely rare cases, if LASIK is performed to correct a corneal disease or trauma unresponsive to other treatments, and is documented thoroughly, it may be considered for coverage—but this is highly uncommon.

LASIK corrects refractive errors for convenience, whereas medically necessary laser surgeries (like SLT for glaucoma or photocoagulation for diabetic retinopathy) treat serious eye conditions that risk vision loss.

Yes, patients may use Health Savings Accounts (HSA), Flexible Spending Accounts (FSA), senior discounts at clinics, or no-interest payment plans like CareCredit to manage LASIK expenses.

No, while Medicare covers standard monofocal lenses, any premium intraocular lens upgrades (like multifocal or toric lenses) must be paid for out-of-pocket by the patient.

Medicaid does not typically cover LASIK either. However, it may help reduce related diagnostic or co-pay costs for medically necessary eye procedures covered by Medicare.

No, Medicare does not cover LASIK even for high degrees of astigmatism if the procedure is performed solely to eliminate the need for glasses or contact lenses.