Tired of glasses or contacts every single day? LASIK eye surgery can truly change your life. But the price tag sometimes makes people hesitate, leading many to ask, “Can you use HSA for LASIK?” Others might wonder about using an FSA for the same procedure.

Good news might be just ahead for you, as these special savings accounts can help cover LASIK costs. This guide explains how these tax-advantaged tools can aid your journey to clearer vision, exploring how using an HSA for LASIK or an FSA for LASIK works. Understanding these options can make a significant financial difference.

Many people find vision correction to be a top priority. If this sounds like you, understanding your payment options is important. These accounts make expensive procedures more accessible.

Table of Contents

Can You Use HSA for LASIK?

Let’s get straight to it. Yes, you generally can use your Health Savings Account (HSA) funds for LASIK eye surgery. LASIK is considered an eligible medical expense by the IRS. This is a huge win for many planning the procedure.

So, is LASIK HSA eligible? The answer is a firm yes. This eligibility opens up a practical way to pay for vision correction.

An HSA is a tax-advantaged savings account. You can contribute to it if you have a High-Deductible Health Plan (HDHP). The money you put in can be pre-tax if through payroll deduction, or it’s tax-deductible if you contribute directly.

This immediately saves you money. Plus, any interest or investment earnings your HSA makes grow tax-free. Withdrawals for qualified medical expenses, like HSA laser eye surgery, are also tax-free, offering a triple tax benefit.

To contribute to an HSA, enrollment in an HDHP is necessary. An HDHP typically has lower monthly premiums but higher deductibles than traditional plans. The IRS defines specific minimum deductibles and maximum out-of-pocket spending limits for a plan to qualify as an HDHP each year, so check current regulations.

The IRS details eligible medical expenses in various publications, such as Publication 502. LASIK aims to correct vision problems like nearsightedness, farsightedness, or astigmatism. Because of this, it typically qualifies as a medical expense.

No specific prescription strength is mandated for HSA use for LASIK. However, the procedure must be for correcting a genuine vision issue. It is not generally for purely cosmetic eye changes, so always confirm your procedure is medically recognized.

Using your HSA for LASIK means you are using your own saved money. You own the HSA account, not your employer. A fantastic feature of HSAs is that the funds roll over year after year without penalty.

There’s no “use-it-or-lose-it” pressure that comes with some other accounts like FSAs. This lets you save up over time if needed. Knowing that LASIK surgery HSA is an option can help you plan better for your future vision needs and other healthcare costs.

The HSA is yours, even if you change jobs or retire. The funds remain in your account, and you can continue to use them for qualified medical expenses. This portability is a major advantage over FSAs, which are generally tied to your current employer.

Annual HSA contribution limits are set by the IRS and differ for self-only and family HDHP coverage. These limits are updated for inflation most years. Individuals aged 55 and older can also make an additional ‘catch-up‘ contribution annually, above the standard limit, offering further savings opportunities.

Your HSA provider can also give you this information and help you understand your account. Many HSAs offer investment options once your account balance reaches a certain threshold, often $1,000 or $2,000. You might be able to invest in mutual funds or other securities, similar to a 401(k).

This allows your funds to potentially grow significantly over time, tax-free. Such growth makes them even more powerful for large medical expenses like LASIK or future healthcare needs. Careful planning of contributions can maximize these benefits.

Can You Use FSA for LASIK?

What about Flexible Spending Accounts (FSAs)? The answer here is also yes. You can generally use FSA funds to pay for LASIK eye surgery.

This provides another great tax-advantaged way to manage the cost. The query of is LASIK FSA eligible finds a positive response. This opens doors for many employees.

An FSA is another type of tax-advantaged account. You can set aside pre-tax money from your paycheck for healthcare expenses. This is an employer-sponsored benefit, so you typically enroll during your company’s open enrollment period.

FSAs reduce your taxable income. This means you pay less in taxes. That’s immediate savings right there, making the procedure more affordable from the start.

A key difference with FSAs is the “use-it-or-lose-it” rule. This means you must typically use the funds within the plan year. While this rule is a core feature, many employers offer some flexibility to assist employees.

They might provide a grace period, typically up to 2.5 months after the plan year ends, to incur and submit claims. Alternatively, some plans may allow you to carry over a limited amount (e.g., $640 for 2024, indexed annually) of unused funds to the next plan year. It’s very important to understand your specific FSA plan rules so you don’t forfeit any of your hard-saved money.

Because LASIK is a planned medical expense, an FSA can be perfect. You can decide how much to contribute during open enrollment. This amount should be based on your LASIK quote and other expected medical costs for the year.

Planning is crucial for FSA LASIK. The FSA contribution limit is also set by the IRS annually. It’s usually per employee, not per family, although the funds can often be used for eligible family members.

Timing your LASIK procedure within your FSA plan year is important. Many people use an FSA for LASIK successfully by doing this. Proper timing maximizes the benefit of your FSA contributions.

Generally, you can use your FSA funds for qualified medical expenses for yourself, your spouse, and your eligible tax dependents. This means if your child or spouse needs LASIK and meets the medical criteria, your FSA can likely cover their procedure. Always check your specific plan documents to confirm coverage for dependents and any specific claim procedures.

If you have an HSA, you generally cannot also have a standard health FSA. However, some employers offer Limited Purpose FSAs (LPFSAs) that can be paired with an HSA. These LPFSAs are restricted to covering eligible dental and vision expenses, including LASIK, allowing you to save even more pre-tax dollars for specific needs.

Related Article

Does Medicare Cover Laser Eye Surgery?What’s the Difference Between HSA and FSA?

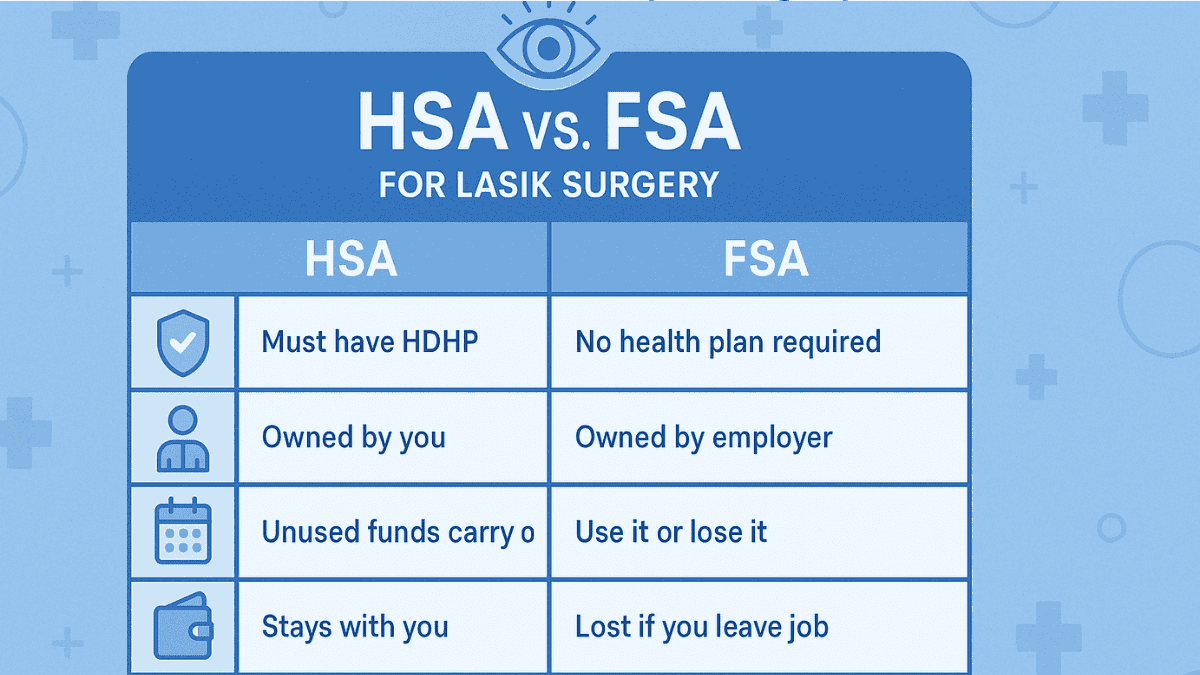

Understanding the main differences between an HSA and an FSA helps you choose. Both let you use pre-tax dollars for medical expenses like LASIK. But, they have different rules and features.

This can influence your decision about how can you use HSA for LASIK or an FSA for the procedure. Knowing these distinctions is valuable for your financial planning.

Here’s a simple comparison:

| Feature | HSA (Health Savings Account) | FSA (Flexible Spending Account) |

|---|---|---|

| Eligibility | Must have a High-Deductible Health Plan (HDHP) | Offered by employers; no specific health plan needed to enroll in FSA itself |

| Ownership | You own the account | The employer owns the account, though funds are for you |

| Rollover | Yes, funds roll over year after year | Generally, “use-it-or-lose-it” annually (some plans have grace period or small rollover) |

| Portability | Yes, account goes with you if you change jobs | No, generally lost if you leave your job (COBRA may allow access for a period) |

| Contributions | From you, your employer, or others; tax-deductible or pre-tax | Primarily pre-tax employee contributions via payroll; employer can also contribute |

| Investment Options | Often available once a certain balance is met | Typically not available |

| LASIK Eligible | Yes | Yes |

So, if you have an HDHP, an HSA offers more flexibility and long-term benefits. The money is yours to keep and grow. This makes Health Savings Account LASIK very attractive for those who qualify.

An FSA is excellent for a planned, significant expense like LASIK eye surgery FSA eligible, especially if you don’t have an HDHP. You just need to be careful with that use-it-or-lose-it rule. Consulting your HR department or benefits administrator can give clarity on your specific options and plan rules.

Which Account Type is Generally Better for LASIK?

The ‘better‘ account for LASIK depends heavily on your individual circumstances. If you have access to an HDHP and can open an HSA, it often provides more long-term value due to fund rollover, portability, and potential investment growth. An HSA is excellent for saving over multiple years for a procedure like LASIK.

An FSA can be a superb choice if you plan to have LASIK within the current plan year and don’t have an HDHP. It’s also beneficial if your employer makes significant contributions to your FSA. The main challenge is carefully managing the ‘use-it-or-lose-it‘ rule to avoid forfeiting funds.

Consider your health insurance options, your timeline for LASIK, and your comfort level with managing potential fund forfeiture when deciding. Some people even use a combination if they have an LPFSA alongside their HSA. Consulting with a benefits advisor or financial planner can also provide personalized guidance.

Related Article

LASIK Eye Surgery ExperienceSteps to Use HSA or FSA for LASIK

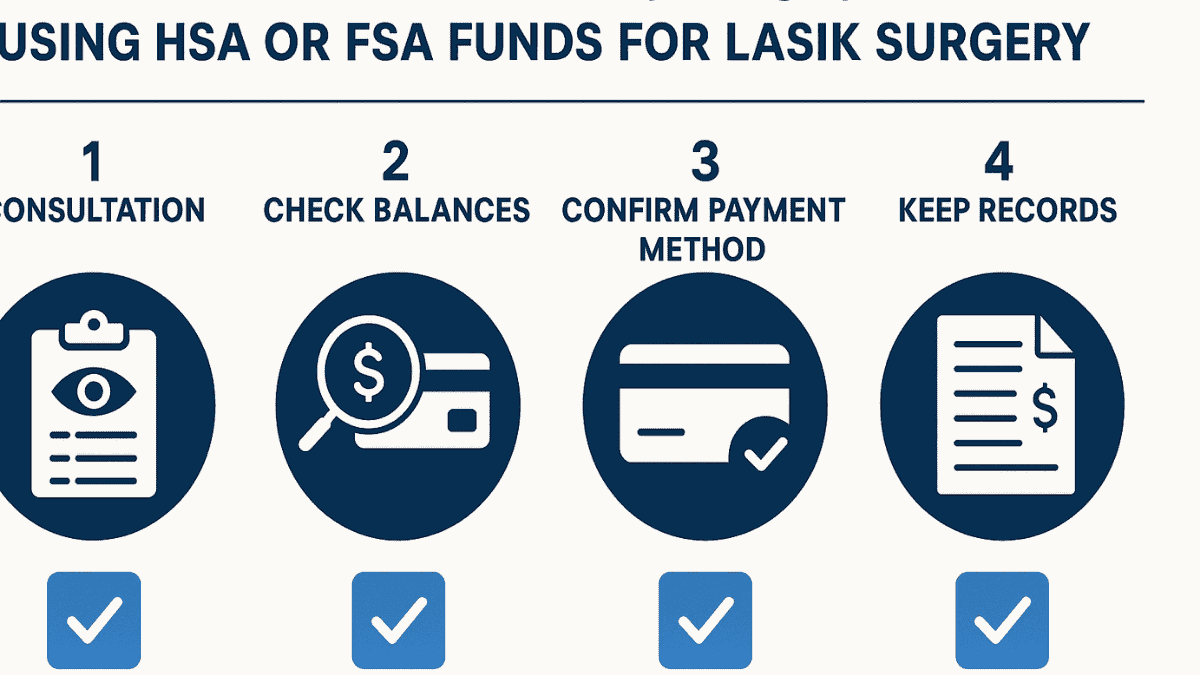

So you’ve decided that using your HSA or FSA for LASIK sounds like a good idea. What’s next? Here are the typical steps to make it happen smoothly.

Following these steps can make your experience straightforward. Proper preparation simplifies the process.

Confirm Your Eligibility for LASIK: First things first, schedule a consultation with a LASIK surgeon. They will determine if you’re a good candidate for the procedure. This visit will also give you a precise cost quote, which is an important step before earmarking your HSA or FSA funds for LASIK. This initial consultation is comprehensive. The eye care professional will perform various tests to measure your vision, check the health of your eyes, and determine if your corneal thickness is adequate for the surgery. They will also discuss the different types of LASIK procedures, potential risks, benefits, and expected recovery time, making you a fully informed patient.

Check Your Account Details: Look at your current HSA or FSA balance. Make sure you have enough funds available. If you’re using an FSA, reconfirm its “use-it-or-lose-it” deadline or check if your plan has any rollover or grace period options, as you’ll want to time your surgery well before any deadlines.

Related Article

How Much Can LASIK Correct?Talk to Your LASIK Provider About Payment: Inform the LASIK clinic that you plan to use HSA or FSA funds. Most clinics are very familiar with these payment methods. Ask if they accept HSA/FSA debit cards directly, or inquire about their process for reimbursement if you pay upfront.

Understand Payment Methods:

- HSA/FSA Debit Card: Many HSA and FSA administrators give you a debit card linked to your account. This is often the easiest way to pay. You simply use it like any other debit card at the clinic for the exact amount of your procedure.

- Reimbursement: If you can’t pay directly with a card, you might need to pay out-of-pocket first. Then, you submit a claim for reimbursement to your HSA or FSA administrator. You’ll need an itemized receipt from the LASIK clinic; obtain all necessary paperwork from your provider. For reimbursement, you will typically need to fill out a claim form provided by your HSA or FSA administrator. This form, along with the itemized receipt showing the date of service, type of service, and cost, is submitted for processing. Reimbursement timelines can vary, so ask your administrator about expected processing times; direct deposit is often an option for faster receipt of funds.

Keep Good Records: This is very important. Save all receipts, invoices, and any explanations of benefits (EOBs), even if less common for LASIK. Keep statements from your HSA/FSA administrator too, as these documents are crucial for your tax records to prove you used the funds for a qualified medical expense, should the IRS ever ask. Good records protect you when dealing with HSA for LASIK or an FSA. This record-keeping is vital not just for your peace of mind, but also for potential IRS audits. Your receipts should clearly show the provider’s name, the service performed (e.g., LASIK surgery), the date of service, and the amount paid. Keeping digital copies in cloud storage can be a good backup strategy to protect against loss or damage of paper records. This diligence ensures you can substantiate your claims if needed.

Related Article

LASIK Eye Surgery StatisticsBy planning these steps, using your tax-advantaged accounts for LASIK can be quite simple. This can make the path to better vision a bit lighter on your wallet. A clear plan helps you access your vision benefits smoothly.

Related Article

Requirements for LASIKPros and Cons of Using HSA/FSA for LASIK

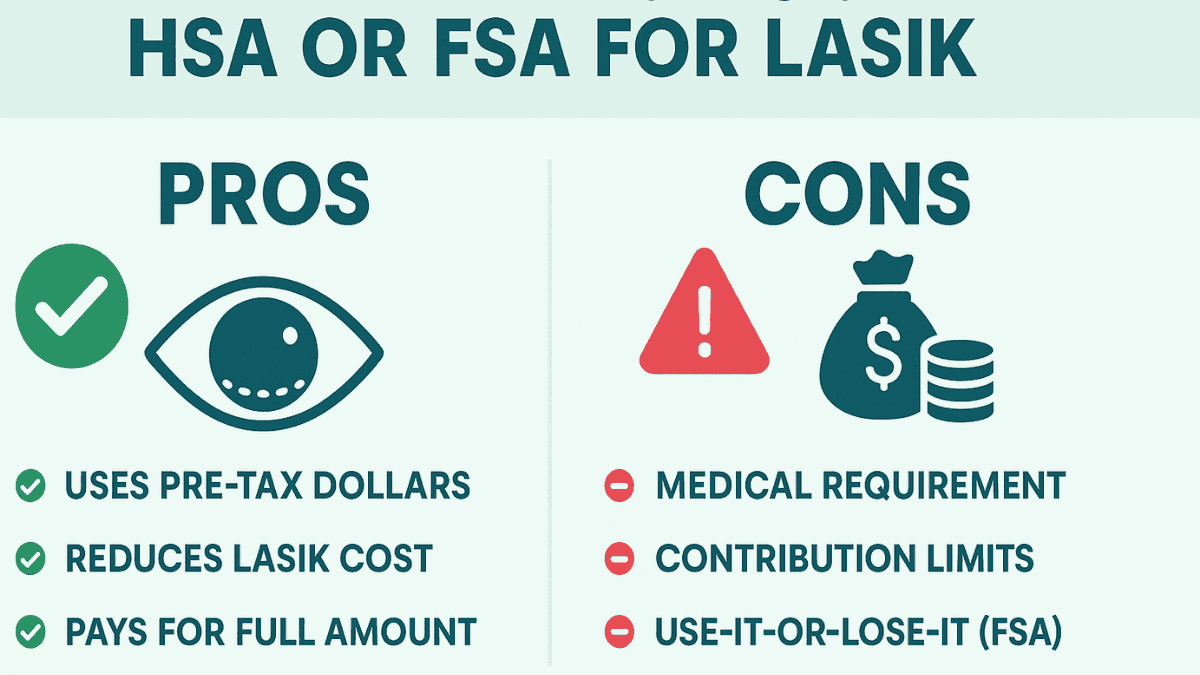

Deciding how to pay for LASIK involves weighing your options. Using an HSA or FSA offers clear benefits, mainly through tax savings. But there are also a few things to keep in mind.

It is sensible to consider both sides when you explore options like hsa for lasik. A balanced view will help you make the best choice.

Related Article

LASIK Eye Surgery CostPros

One huge advantage is the tax savings. When you contribute to an HSA or FSA, that money is usually pre-tax. This means it lowers your overall taxable income.

You essentially save an amount equal to your tax rate on the cost of LASIK. This can add up to hundreds, or even thousands, of dollars. This is a big part of why is LASIK HSA eligible is such good news for so many.

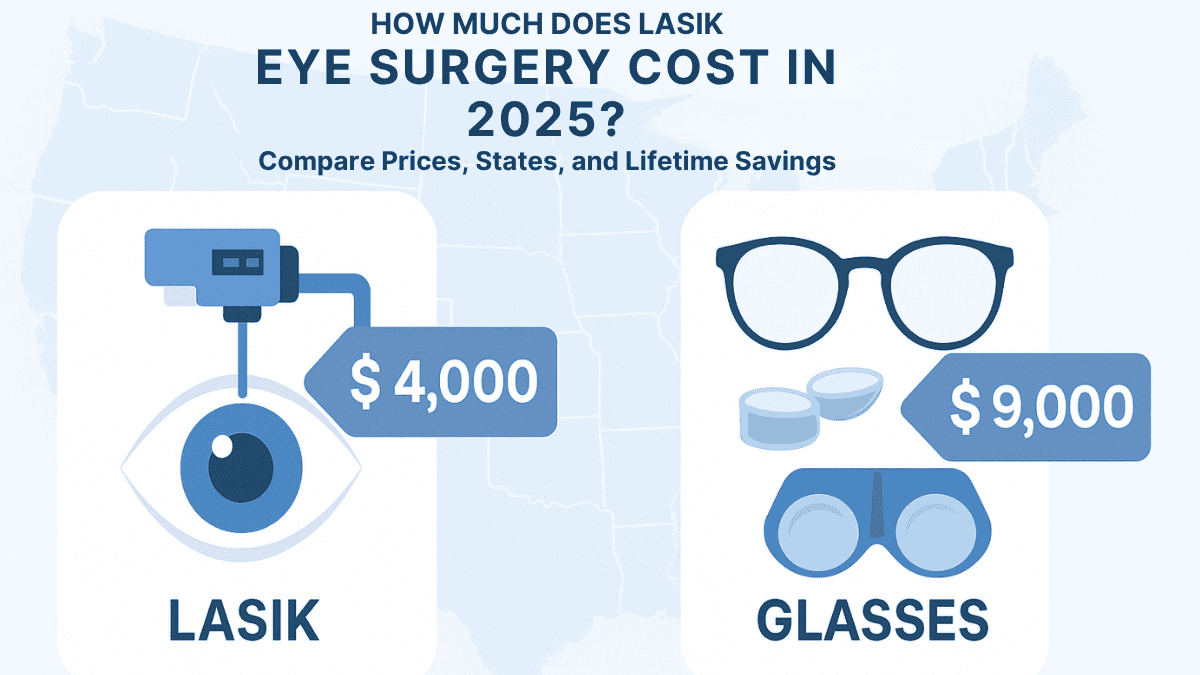

For instance, if your LASIK procedure costs $4,500 and you are in a combined federal and state 25% tax bracket, contributing that amount to an HSA or FSA pre-tax effectively saves you $1,125. This is because you are not paying income tax on the $4,500 used for the surgery. This substantial saving directly reduces the out-of-pocket cost of LASIK.

Another pro is avoiding debt. You are using your own saved money. So, you avoid taking out loans or using credit cards that charge interest.

Interest payments can significantly increase the total cost of LASIK over time. Using saved funds from an HSA or FSA sidesteps this extra expense. This approach supports good financial wellness.

With an HSA, your money can grow tax-free. If you’ve been saving in an HSA for a while, any investment gains are also tax-free when used for qualified medical expenses. This makes your HSA laser eye surgery even more affordable over the long run.

For FSAs, they are great for planned expenses. LASIK fits this description perfectly. You can plan your FSA contribution to cover the cost within the plan year.

This targeted saving can be very effective for Flexible Spending Account LASIK users. It allows for precise budgeting for a significant medical procedure. This predictability is a strong point for FSAs.

Cons

One potential downside is contribution limits. The IRS sets annual limits on how much you can put into an HSA or FSA. LASIK can be expensive, sometimes costing more than you can contribute in a single year.

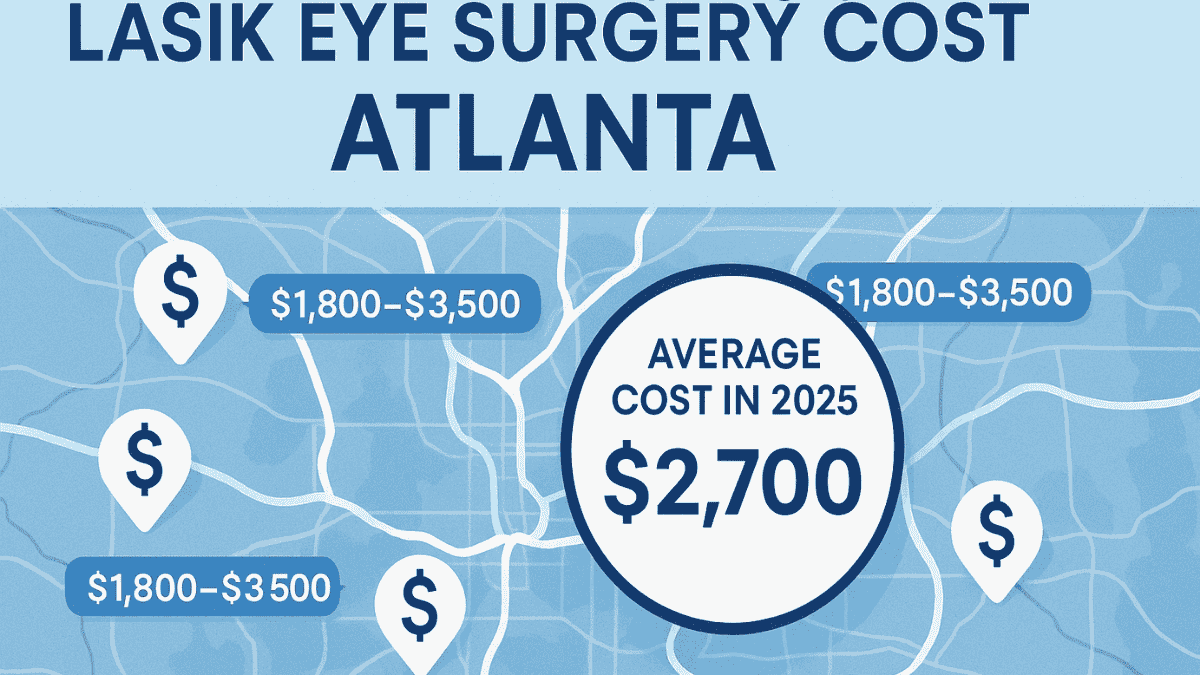

This means you might need to plan contributions over a couple of years for an HSA. Or you may need to supplement with other funds. For 2024, the HSA contribution limit is $4,150 for self-only HDHP coverage and $8,300 for family coverage; the FSA contribution limit for health expenses is $3,200.

Since LASIK can often cost between $4,000 and $6,000 or more for both eyes, you might need to use HSA funds accumulated over more than one year. Alternatively, you could combine FSA funds with other payment methods if the cost exceeds the annual FSA limit. Always check current IRS limits as they can change.

The “use-it-or-lose-it” rule for FSAs is a significant consideration. If you overestimate your medical expenses and contribute too much to your FSA, you could lose that unused money. Careful planning is essential if using FSA for LASIK.

Always double-check your employer’s specific FSA rules about deadlines or any carryover provisions. Some plans allow a small rollover amount, which can help, but relying on this without confirming details can be risky. Understanding these rules is paramount.

To contribute to an HSA, you must be enrolled in a High-Deductible Health Plan (HDHP). Not everyone has access to an HDHP. Or, some may prefer a different type of health plan for their overall medical needs.

This can limit your ability to use an HSA for LASIK eye surgery. HDHPs, while offering lower premiums, mean you pay more out-of-pocket for medical services until you meet the high deductible. This trade-off isn’t suitable for everyone’s healthcare needs or financial situation.

Some HSA accounts might have small monthly fees or transaction fees. While usually not high, it’s good to be aware of any costs associated with your specific account. Also, the responsibility for keeping good records falls on you.

You need to save receipts to prove expenses were eligible for tax purposes. This diligence is important for both LASIK surgery HSA and FSA uses. Failure to do so could lead to issues if audited by the IRS.

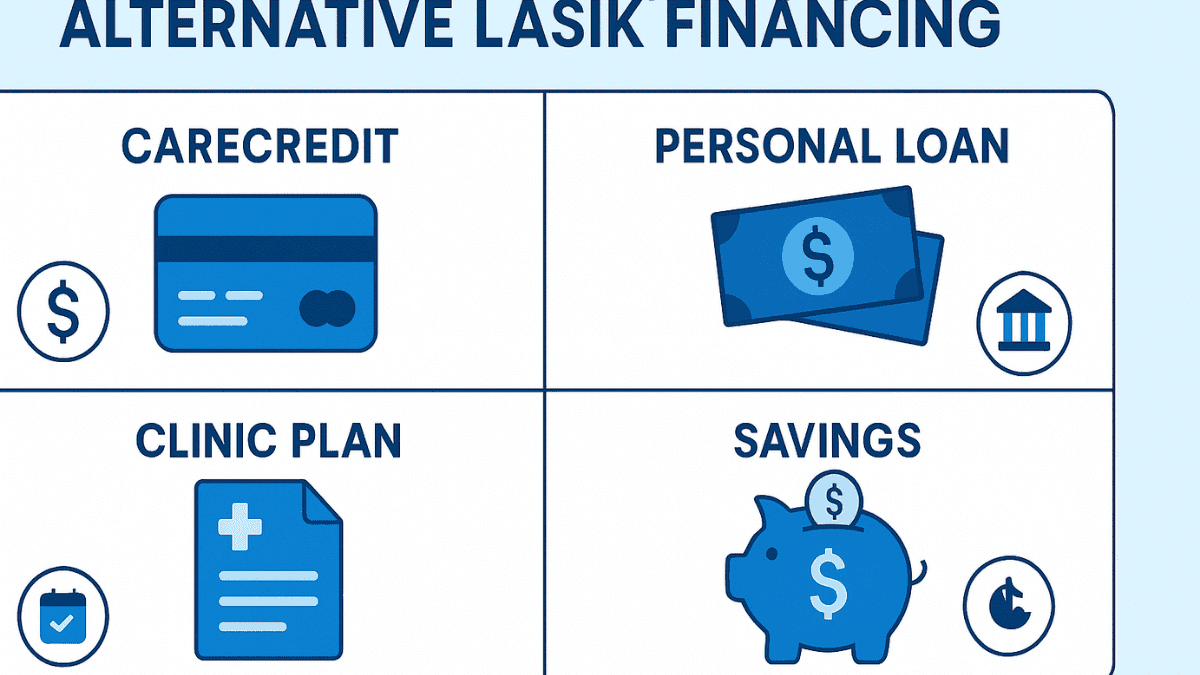

Alternative Ways to Pay for LASIK (If No HSA/FSA)

What if you don’t have an HSA or FSA? Or maybe you don’t have enough in those accounts to cover the full cost of LASIK? Don’t worry.

There are still other ways to finance your path to clearer vision. Many people successfully pay for LASIK using these methods. Exploring these alternatives can help you find a suitable solution.

One common option is a healthcare credit card, like CareCredit. These cards are specifically for medical expenses. They often offer promotional financing periods with 0% interest for a set time.

For example, you might get 6, 12, or even 24 months interest-free. This can be a great deal if you can pay off the balance within that promotional window. However, be very careful with these offers.

If you don’t pay it off in time, the interest rates can be quite high. When considering healthcare credit cards, it is crucial to read all terms and conditions. The 0% interest offers are typically ‘deferred interest‘ promotions, meaning if you don’t pay the entire balance by the end of the promotional period, interest can be charged retroactively on the original amount from the purchase date.

Many LASIK clinics offer their own in-house financing plans. These plans allow you to make monthly payments directly to the clinic. Compare the interest rates and terms carefully with other options.

Sometimes, this can be a convenient way to manage the expense of LASIK eye surgery. When discussing in-house financing, ask about the exact interest rate (APR), the length of the loan term, and any application fees, origination fees, or prepayment penalties. Some clinics partner with third-party financing companies, so understand who is actually providing the loan.

A personal loan from your bank or a credit union could be another route. These loans might offer more favorable interest rates than standard credit cards. It’s worth shopping around and comparing offers from different financial institutions.

Personal loans can come with fixed interest rates, meaning your payment remains the same throughout the loan, or variable rates, which can change over time. Most personal loans for medical expenses are unsecured. Your credit score will significantly influence the interest rate you qualify for, so it’s good to know your credit standing beforehand.

You can also use regular credit cards. If you have a card with a low annual percentage rate (APR) or a 0% introductory APR offer, this might work. Just be sure you understand the interest rate that will apply after any promotional period ends.

You don’t want unexpected high interest charges adding to your cost. Careful review of card terms is important. This can prevent future financial strain.

Of course, there’s always the option of saving up. Paying for LASIK with money you’ve already saved means you avoid interest and debt altogether. While it might take longer, it’s a financially sound approach.

To save effectively, establish a clear savings goal based on your LASIK quote. Break this down into monthly or weekly savings targets. Setting up automatic transfers from your checking account to a dedicated savings account can make the process easier and more consistent.

Don’t forget to ask about discounts. Some clinics offer a small discount if you pay the full amount upfront in cash or with a check. This saves them credit card processing fees.

Also, check if your vision insurance plan offers any discount programs for LASIK, even if it doesn’t cover the procedure outright. Some insurers partner with LASIK centers to provide a percentage off. These partnerships can offer significant savings.

Additionally, many clinics offer discounts for military personnel, veterans, first responders, or students. Beyond these, some LASIK centers offer promotions during certain times of the year or for specific patient groups like teachers or government employees. Always ask specifically what discount programs the clinic participates in before deciding about your payment method for LASIK eye surgery, especially if not using an HSA for LASIK.

Related Article

Best Country for LASIK Eye SurgeryConclusion

So, back to the main question: can you use HSA for LASIK or an FSA? The answer is a clear yes. Both Health Savings Accounts and Flexible Spending Accounts are excellent tools.

They can help make LASIK more affordable through valuable tax savings. This knowledge about your Health Savings Account LASIK options is empowering. Making an informed choice can save you money and stress.

Remember, careful planning is important. Choose the account that fits your situation best. Understand the rules, especially the “use-it-or-lose-it” aspect of FSAs and the HDHP requirement for HSAs.

Timing your contributions and your surgery also matters. Talking with your HR department or benefits administrator can provide great help. Your LASIK provider can also explain their payment policies for these accounts and any other financing options they may offer.

With smart financial planning, achieving better vision through LASIK is well within reach. It’s an investment in your quality of life. The benefits of clear sight often extend far beyond the initial cost of the procedure.

FAQ

Yes, LASIK is an eligible medical expense under IRS rules, so you can use your HSA to pay for it tax-free.

Yes, the IRS includes LASIK under qualified medical expenses as it corrects vision-related impairments.

No specific prescription strength is required, but the procedure must address a legitimate vision condition.

Yes, LASIK is also eligible under Flexible Spending Accounts (FSA), although FSA funds usually expire yearly.

HSAs offer rollover, investment options, and portability, while FSAs are more restricted and often have use-it-or-lose-it deadlines.

Yes, pre-operative consultations and exams directly related to LASIK are generally eligible expenses.

Usually no, unless your FSA is a limited-purpose FSA (LPFSA) specifically designed for dental and vision.

Yes, HSA funds can be used for your spouse or eligible dependents’ medical expenses, including LASIK.

Yes, if the procedure is medically necessary, HSA funds can be used for bilateral LASIK surgery.

No, as long as you have enough balance, you can use the full amount for your LASIK procedure.

You can partially pay with HSA and cover the remainder through other means like credit or financing.

It can. Always keep receipts and documentation to prove LASIK was a qualified expense.

Yes, if these are medically necessary and not purely cosmetic, they’re typically eligible.

Yes, prescribed medications after surgery, such as antibiotic or anti-inflammatory drops, are eligible.

Yes, procedures like PRK or SMILE may also qualify if medically necessary.

Yes, your HSA is portable and remains yours even if you switch employers or retire.

For 2025, the limit is $4,150 for individuals and $8,300 for families, with an extra $1,000 catch-up for age 55+.

Possibly. If you itemize deductions and your medical costs exceed 7.5% of your AGI, it may be deductible.

Yes, many HSA plans allow investing, and gains used for qualified expenses like LASIK are tax-free.

Most clinics accept HSA debit cards, but check with your provider to ensure compatibility and process.

Sources

HSA Center – What is an HSA?